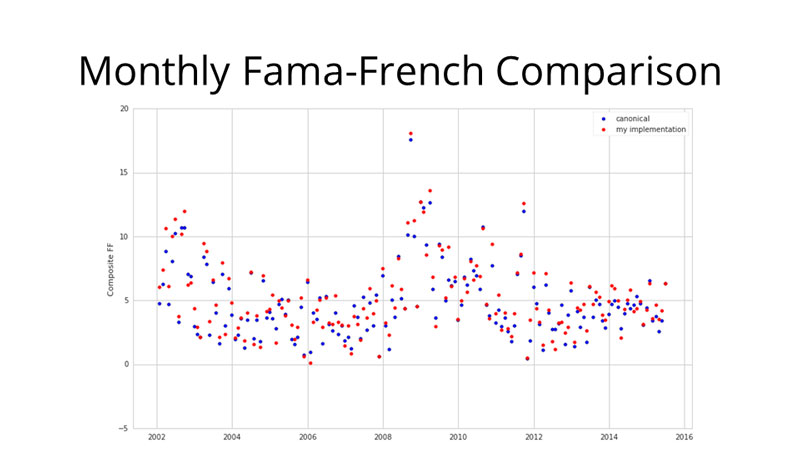

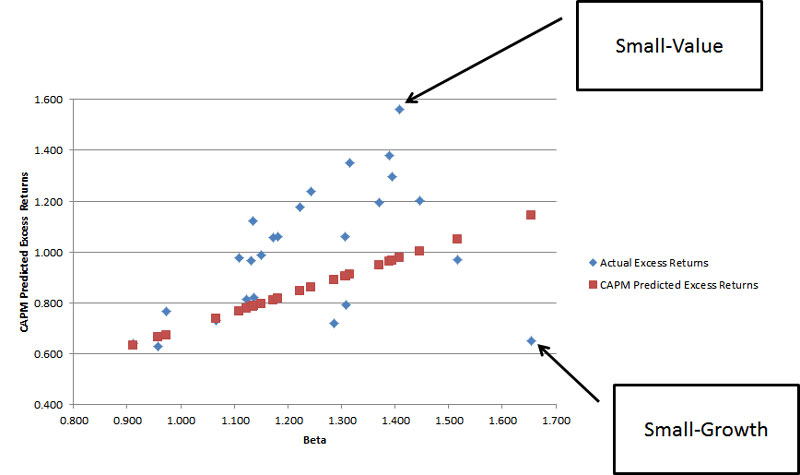

The Fama and French Three-Factor Model is a pricing model for assets developed in 1992 by Fama and French. It is an expansion of the capital asset pricing model (CAPM) that adds size and value risk factors to the CAPM's market risk factor. This model considers that value equities and small-cap companies routinely beat the market as a whole. It is believed that the model is an improved instrument for judging managers' performance since it accounts for the propensity of managers to exceed their peers by including these two extra characteristics.

Understanding

Eugene Fama, winner of the Nobel Prize in Economic Sciences, and Kenneth French, a researcher and a former professor at the University of Chicago Booth School of Business, collaborated on an effort to improve the accuracy of measuring market returns and discovered, through their research. Similarly, the performance of small-cap stocks is often superior to that of large-cap equities.

The Fama and French model considers three variables: the ratio of a company's book value to its market value, the model's excess return on the market, and the company's size. To put it another way, the three elements that are taken into consideration are "small minus large," "high minus low," and "the return on the portfolio less the risk-free rate of return." The term "SMB" refers to publicly listed firms with a tiny market capitalization that creates better returns.

There is a great deal of discussion on whether or not the trend toward outperformance can be attributed to efficient market operation. The extra risk often justifies the outperformance that value and small-cap companies experience due to their higher cost of capital and more business risk. This is done to promote the notion that the market is operating efficiently. The outperformance is explained by market participants erroneously pricing the worth of these enterprises, which gives the extra return in the long term when the value adjusts, lending credence to the hypothesis that the market is inefficient. The Efficient Markets Hypothesis (EMH) provides evidence, and investors who adhere to this evidence are more inclined to agree with the efficiency side of the argument.

Fama and French emphasized the importance of an investor's capacity to withstand the additional volatility and periodic underperformance that can take place over a short period. Investors with a time horizon of 15 years or more will be compensated for losses incurred in the near term, even if they may have had losses in the long run. Fama and French tested their model using thousands of randomized stock portfolios. They found that when the size and value factors were combined with the beta factor, they could explain as much as 95 percent of the return in a diversified stock portfolio. This was discovered through studies that Fama and French conducted to test their model.

Fama and French’s Five Factor Model

Researchers have recently modified the Three-Factor model to incorporate extra components in addition to the original three. A few examples of this include the terms "momentum" and "quality," as well as "low volatility." In 2014, Fama and French modified their model so that it would take into account five different criteria. The new model incorporates not just the three components included in the model's predecessor but also the idea that firms that forecast greater future profits may expect better returns on the stock market. This idea is referred to as the profitability factor. The fifth component, known as "investment," connects the idea of internal investment and returns. This suggests that businesses that funnel their profits into significant expansion endeavors are more likely to suffer financial losses on the stock market.

Can You Please Name Each of the Model's Three Factors?

The Fama and French model considers three variables: the ratio of a company's book value to its market value, the model's excess return on the market, and the company's size. To put it another way, the three parameters considered are "little minus large," "high minus low," and the return on the portfolio subtracted from the risk-free rate of return. The term "SMB" refers to publicly listed firms with a tiny market capitalization that creates better returns.