-

Taxes

TaxesHow Can You Pay Your Property Tax Bill?

Feb 05, 2024Property taxes are collected by local governments to help fund community services and projects. Ad valorem property taxes are levied depending on a property's worth. It's possible that your property tax will be folded into the payment that you make each month for your mortgage if you have mortgage. Otherwise, you'll have to pay the tax office. Personal property taxes, such as those on a car, boat, or recreational vehicle, may also be due.

-

Taxes

TaxesCalculating Adjusted Gross Income (AGI) for Tax Purposes

Jan 15, 2024Calculating your AGI begins with totalling all of your taxable income for the year, including your wage, self-employment profits, and 1099-INT profits such as dividends and pension payments.

-

Taxes

TaxesForm 4952: Deduction for Investment Interest Expense

Nov 07, 2023Several itemized deductions have been deleted by the Tax Cuts and Jobs Act (TCJA) from 2018 until at least 2025. The investment interest deduction, on the other hand, was left untouched. Taxpayers who itemize their investment interest expenditures on Schedule A of Form 1040 can still deduct the interest they pay on their investments.

-

Taxes

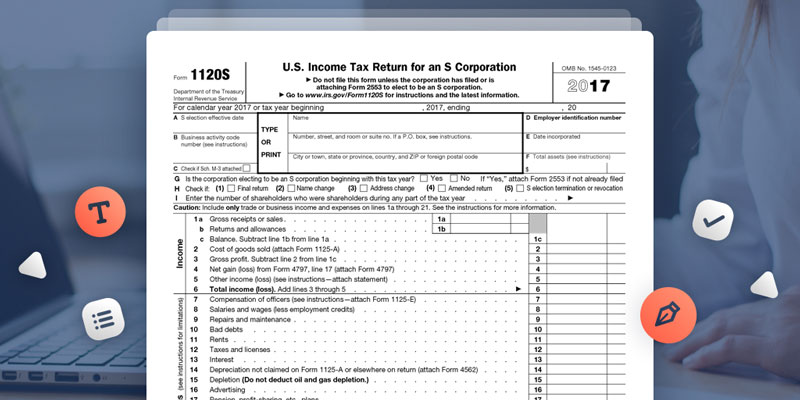

TaxesForm 1120-S

Jan 01, 2024For any tax year covered by an election to become an S corporation, use Form 1120-S. This allows you to report income, gains, losses, and deductions of domestic corporations or other entities.