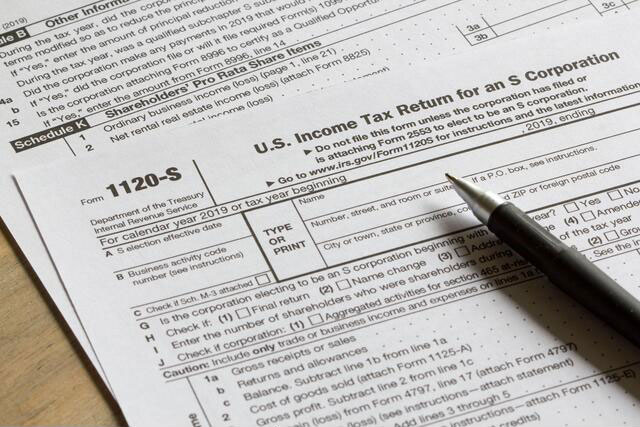

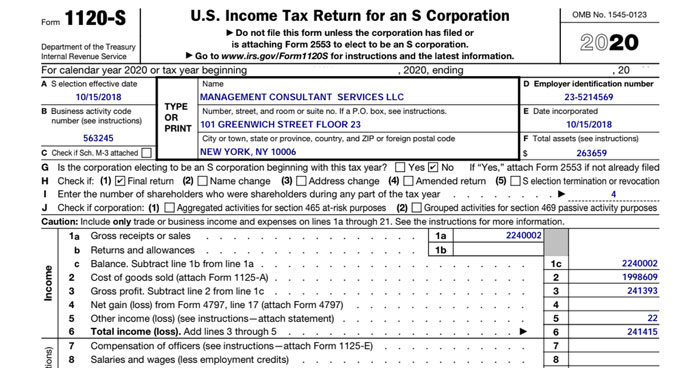

The U.S. Income tax return for an S Corporation Form 1120-S is a tax document that reports income, losses, and dividends to S corporation shareholders. Form 1120-S, which is essentially an S corporation tax return, is what it does.

Schedule K-1 can be attached to either Form 1120-S or Form 1065. Schedule K-1 is a form that identifies each shareholder's share of company shares for the tax year. It must be completed for each shareholder. For partnerships, Form 1065 must be submitted instead of Form 1120 S.

Who Needs Form 1120-S?

If a corporation elects to become an S corporation, it must file Form 1120–S. To determine how much profit or loss an individual shareholder should receive, the IRS uses Form 1120-S' ownership percentage. Profit and loss can be easily calculated if the shareholder doesn't see any change in this percentage over the year. Profit and loss are calculated per share if an individual buys additional shares or sells or transfers holdings.

How to File

Form 1120 and any other forms, schedules, and attachments may be submitted electronically by corporations using the e-file system. This includes documents such as Form 7004, which enables an automatic extension of time, and Forms 940-941 and 944, which enable employment tax returns. You may finish your return by logging in to modernized eFile and doing it online. If you owe money to the IRS in taxes, you have the option of authorizing the electronic withdrawal of that money from your account. You can also authorize a direct deposit or request a refund.

Particular Considerations When Filing

Why file Form 1120-S?

To avoid double federal taxes, corporations with less than 100 shareholders can form an S corporation. The corporation transfers its income to shareholders for taxation purposes. The corporation is not taxed but the shareholders. Additionally, the cash method can be used if the corporation doesn't have significant inventory. This method can be much simpler than the accrual. S corporations offer significant benefits, but they also have some disadvantages. They are subject to the same rules as corporations (C-corporations) and must pay high tax and legal service fees.

What C and S Corporations Have in Common

Both C and S corporations must file articles of incorporation. They also need to hold regular meetings for shareholders and directors with detailed minutes. These meetings should allow shareholders to vote on corporate decisions, such as mergers and acquisitions or management restructuring.

S corporations and C corpora have the same legal and accounting setup costs. S corporations are limited to issuing one type of stock. C corporations can issue multiple classes of stock. This can be said to limit a company’s ability to raise capital.

For federal taxes, Form 1120-S can be filed by the S Corps. Form 1120-S for taxes is filed for tax purposes by C Corps. C Corps and S Corps are both corporations, but they offer different benefits and disadvantages for business owners.

C Corporations cannot be passed-through entities like S Corps. C Corps must file Form 1120 with IRS. They also have to pay federal income tax at a corporate level. C Corp shareholders must pay personal income tax on their salaries and any dividends they receive from the corporation.

- C Corps can have an unlimited number of shareholders

- Shareholders don't have to be US citizens or legal residents

- C Corps may have multiple stock classes

- C Corps has a lower minimum tax

- C Corps have a greater chance of securing external financing

Why is Form 1120-S important?

S corp members need Form 1120-S to report income. It also informs the IRS how much of the company is owned or controlled by shareholders. This information will determine any refunds or tax payments that shareholders are due on their individual income tax returns. This information will determine whether the owners of a business are liable for tax.