Introduction

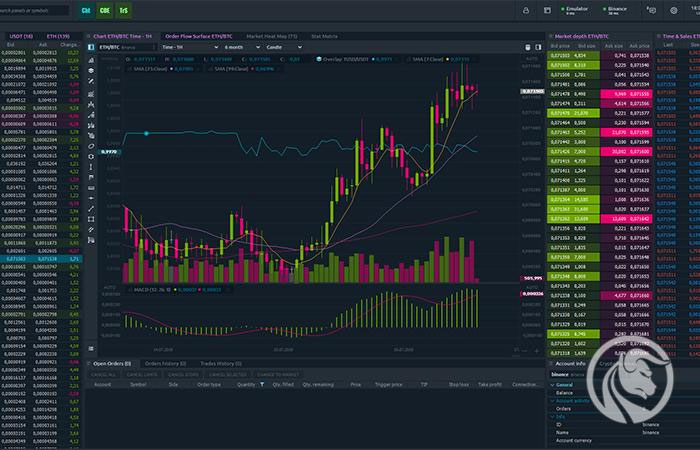

What is a Trading Platform? The trading platform is software that enables investors and traders to track accounts and execute trades through intermediaries. Additionally, trading systems offer real-time charting, real-time quotations, applications, news feeds, and even advanced analysis. Further, they can be tailored to specific markets like futures, FX, equities, and options.

There are two different kinds of trading platforms, including corporate websites and prop platforms. Commercial websites cater to day traders and small-time investors, as the name suggests. They stand out for their simplicity of use and various helpful research and investor education tools, such as updates and map features.

On the other hand, Prop platforms are specialized platforms developed by large brokerages to match their unique criteria and trading style. Traders use a variety of platforms depending on the nature and size of their trades.

Choose a Platform

Investors and traders should know the fees involved in using their services and the amenities offered by trading platforms. While traders who trade options may need specialized software explicitly created to simulate trading strategies for options, day traders and other traders who trade in a short time frame may need additional features, such as Level 2 quotes and Market maker's depth charts, to help them make decisions. Fees play a significant role in deciding which trading platforms to use. Scalping traders favor low-fee trading platforms when using this type of trading method.

Traditional Trading Vs. Electronic Trading

Even though many people like the traditional broker-client relationship, technological advancements in the trading industry have led some people to convert from the conventional method to online trading strategies. These two trading methods differ significantly in a few key ways, and the one ideal for you will depend on your preference. To help you choose wisely based on your interests, this table illustrates some of the critical distinctions between conventional and internet-based trading strategies.

Online Trading Platform Function

Thanks to our computerized world, when you sell or buy on an e-trading platform, your transaction is finished in a matter of seconds. Learn how to use this trading platform:

- Enter your order after logging into your account and your broker's website.

- The order will then be saved in an electronic database after that.

- The database evaluates all trading markets and establishes your most advantageous pricing.

- The buyer communicates with both parties when buyers and sellers are matched in the market.

- All investors can see the order as well as the price.

- Electronic trading keeps a record if it becomes necessary to look back at previous transactions.

- The technology also transmits a contract between the broker who purchased the shares and the broker who bought the shares.

What is the Idea?

You may make money through trading. Profitable traders should be prepared to work hard to get significant investment returns regardless of market conditions. The best way to raise your effectiveness and skills when you first start trading is to use an online platform that enables you to reduce risk and develop your skills in a secure setting. If you're a trader who needs the speed and flexibility of a credible trading environment, or if you're an investor who needs access to the market while you're on the move, The optimum setting is on an e-trading platform. If you're new to online trading, you could feel overwhelmed by the variety of options on the site and may choose to employ a brokerage company to handle the transaction on your behalf. With all of this in mind, hiring electronic trading software for your company will have the following advantages:

- You can keep an eye on your development in real-time.

- Your investment is under your control.

- The bias that brokers may introduce can potentially be eliminated.

- Your trades can stop losing or make money once they hit the set level.

- You have simple control over your actions and emotions.

With that in mind, we decided to build an E-Trading Platform with all the crucial components required for more effective trading. Doesn't it sound impressive? Here, let's get into the specifics!

Admin Roles

In this section, we'll define the roles that grant users specific rights and give them access to platform features and functions. The e-trading system offers three levels of user access.

- A person who buys or sells assets through an online trading platform is referred to as a "trader."

- Broker: a person authorized to trade stocks on an electronic trading platform.

- Organization of the project

Here, you can read about the project's specifics and learn about the technologies used to advance trading.

Conclusion

Customers are becoming more tech-savvy and pickier about the quality of the goods and services they buy as the business environment becomes more complicated. Businesses offer more specialized advisory services and financial solutions to serve their clients better. We at DDI Development have established expertise in creating various mobile and online solutions for different sectors. Let us know if you're thinking of trading online, and we'll turn your idea into a working piece of software.