This is also known as the rate of transformation at the margin. The number of units of good Y will be skipped over to manufacture one more unit of good X, assuming that all other production variables and technological advances remain unchanged.

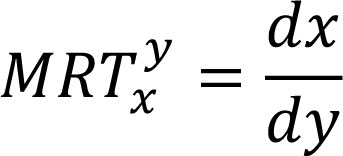

Therefore, the ratio will inform you how much Y must be sacrificed to create another X. The marginal rate of transformation, also known as MRT, is determined by dividing the marginal cost of manufacturing another unit of an item by the resources that are made available as a result of reducing the production of another unit. The formula shown above calculates the marginal revenue target (MRT) by dividing the marginal cost of production for good X by the marginal cost of production for good Y.

Using The Marginal Rate Of Transformation (MRT)

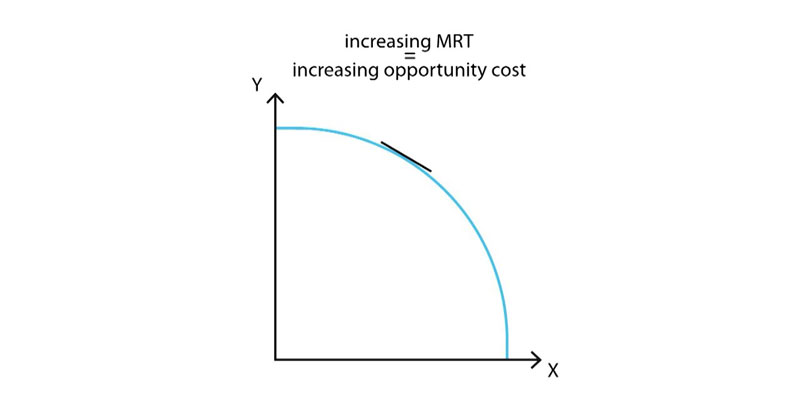

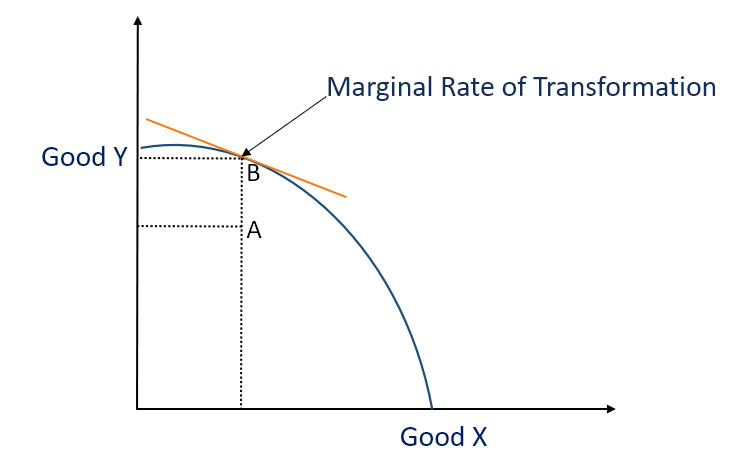

Economists can evaluate the opportunity costs associated with producing one more unit of anything by using the marginal rate of transformation (MRT) concept. In this instance, the opportunity cost is shown by creating a different kind of good that will not be made. The marginal rate of transformation is directly related to the PPF. The marginal revenue target, or MRT, is defined as the absolute value of the slope of the production possibility frontier. There is a special transformation rate at the border, which is shown as a curved line associated with each location on the frontier. The comparative costs of manufacturing the two different commodities informed this pricing structure.

Because the resources are effectively distributed along the production potential frontier at each location, increasing the production of one good results in a corresponding decrease in the production of the other. In other words, the resources utilized to make one commodity are diverted from the production of other things, which results in a reduction in the production of the other commodities. The marginal rate of transformation is used to determine the value of this tradeoff (MRT). Moving down (down) the PPF often increases the absolute value of the MRT, as well as an increase the opportunity cost. The opportunity cost of producing one item increases the number of units needed to create the other good. The rule of decreasing returns might be considered an analog to this occurrence.

Example Of How To Use The Marginal Rate Of Transformation

The marginal replacement threshold (MRT) refers to the rate at which a modest quantity of Y may be sacrificed in exchange for a modest amount of X. The rate may be considered the potential cost of producing one unit of one item rather than another. The transformation rate is susceptible to change whenever there is a shift in the number of X units to Y units. The MRT will be equal to one for commodities with no room for improvement and will not change.

For example, if the production of one less cake frees up sufficient resources to produce three more loaves of bread, then the transformation rate at the margin is three to one. You may also think about the fact that it costs $3 to prepare a cake. Meanwhile, skipping preparing a loaf of bread is a good way to save one dollar. Therefore, the MRT equals 3, which equals $3 divided by $1. Consider a different scenario, this time that of a student who must choose between spending more time studying to improve their marks in a certain subject or spending some of their spare time doing something else. The marginal rate of production (MRT) is the rate at which a student's grade improves when more of their leisure time is sacrificed for academic pursuits. This rate is represented by the absolute value of the slope of the production possibility frontier curve.

The Distinction Between The Marginal Rate Of Substitution And The Marginal Rate

It is important to note that they are not the same thing. The marginal replacement rate illustrates the number of additional units of Y that a certain consumer group would perceive as compensation for losing one more unit of X. For instance, a customer who would rather have oranges than apples could not feel the same level of contentment until she is given three apples instead of one orange.

Constraints Imposed By The Use Of The Marginal Rate

In most cases, the marginal rate of transformation, often known as the MRT, does not remain constant and may frequently need recalculation. In addition, if MRT does not equal MRS, then the distribution of commodities will not be done effectively. The comparative costs of manufacturing the two different commodities informed this pricing structure.